Banking on SA's best franchises

South African banks have been rewarding investors since the post-COVID lows — however, the operating environment continues to be tough. Economic growth remains anaemic, interest rates are likely to drift lower, and competition is heating up in payments and SME banking. In this context, analyst BYRON JACKSON-MILLER explains why selective positioning makes more sense than blanket exposure.

The SA banking landscape

Banking in South Africa is a heavily competitive industry, despite high levels of regulation and concentration. Banks must use leverage to generate returns above the cost of their regulatory capital. Banking profit margins tend to compress whenever economic growth falters and bad debts start to expand.

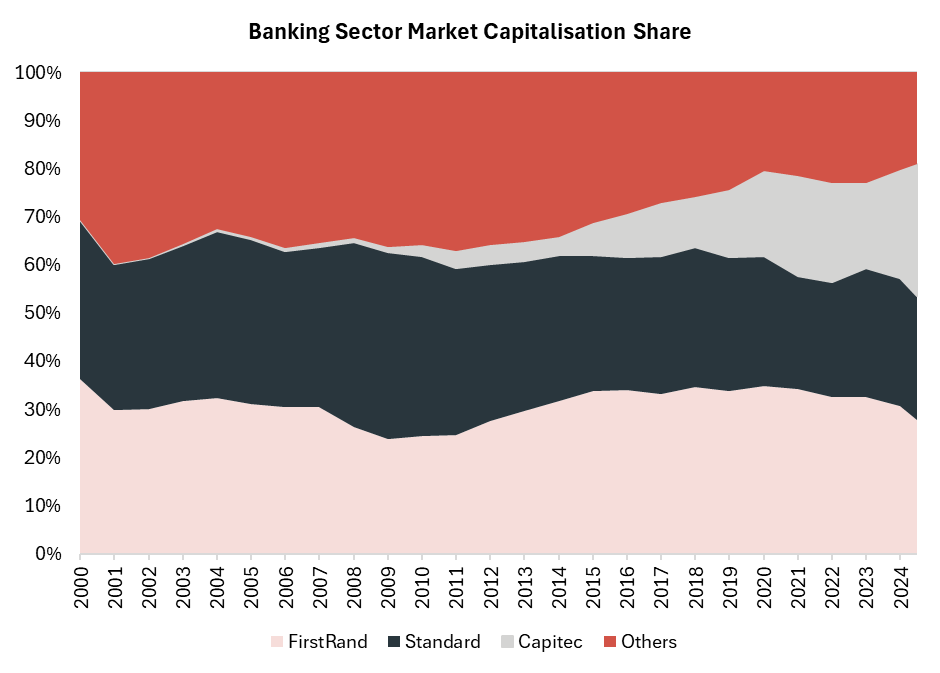

Banking is also a commoditised industry where cost initiatives have been an important part of earnings growth. An example is Standard Bank’s 42% reduction in branch footprint since 2017. Opportunities to cut costs are now largely exhausted. We also expect Capitec to continue to disrupt large pools of fee income on which the big banks have historically relied. The chart below illustrates how the higher quality banks have taken JSE market cap share over the last 25 years.

Source: Factset

In this context, it is important to be conscious of the specifics of each business. Foord has been selective in choosing to own the banks with unique opportunities and advantages. This also reflects caution about South Africa’s economic growth prospects, the paucity of significant capital lending projects, and banks earning less when interest rates decline, as they are now doing (known as the endowment effect — see ‘Did You Know?’).

Preferred bank investments

Despite our relative caution towards the sector, select banking stocks feature in our top-10 holdings. Standard Bank tops our preference list. Standard Bank owns a pan-African franchise that is difficult to replicate and which drives earnings diversity. Its corporate and investment banking divisions also position it for any infrastructure-led upswing. We expect steady cash-flow growth from this blue-chip company still trading on an attractive valuation.

We have also added opportunistically to Capitec. Management execution has proven unusually reliable, and we expect more to come: of its 24 million clients, only nine million are fully banked — leaving room for growth amongst its customer base. Capitec’s knack for embedded services — airtime, vouchers, funeral cover — layers revenue at minimal incremental cost. Early moves into SME banking via low-cost point-of-sale devices mirrors Capitec’s disruptive retail strategy of twenty years ago.

FirstRand is a multi-decade core holding in our funds. FirstRand remains best-of-breed in most banking segments in South Africa. It is well positioned to continue to win business from weaker competitors in a tough operating environment. We are closely monitoring the mis-selling litigation relating to FirstRand’s UK subsidiary, MotoNovo, but probability-weighted outcomes still justify continued exposure to the share.

Four near-term priorities for the SA banking industry

There are four major themes playing out in the SA banking industry that will affect market share and investment outcomes:

Digital payments: SARB’s PayShap project — instant real-time transfers between bank accounts or mobile wallets — aims to slash cash usage that still accounts for over half of all point-of-sale transactions in South Africa. More than 80% of South Africans have a bank account, but in half of these cash is withdrawn as soon as its deposited. Fee income is at risk for incumbents, but there are opportunities: to capture this payments trend, Capitec is rolling out its white-and-blue contactless payment terminals to small-and-medium enterprises 50% cheaper than peers.

SME banking: Capitec is aggressively expanding into the underserved bottom end of the business banking market, while Investec is bringing its private banking service levels to slightly larger businesses. Scale without legacy IT offers a cost edge that incumbents must counter.

Leadership changes: Jason Quinn’s move from Absa to Nedbank and Kenny Fihla’s arrival at Absa from Standard Bank highlight the cultural overhaul underway within the sector.

Non-lending ecosystems: Banks increasingly monetise app traffic through value-added-services and embedded products. Nothing knows you better — or gets more of your attention — than your banking app. FirstRand and Capitec already use client transaction data to undercut external insurance policy premiums and airtime. Foreign-exchange remittances are next.

Investment implications

Credit growth and impairment trends will drive short-term share price direction. However, medium-term winners in the sector will be those banks with technological agility, fee resilience and disciplined capital allocation. An internal culture that can adapt to change will be important.

We have reduced our banking weight in the Foord Equity Fund, but remain long-term investors in its best franchises. In a low-growth economy, owning the price-setters — not the price-takers — remains the surest way to compound shareholder value. We favour banks that are shaping industry shifts rather than reacting to them. Standard Bank’s continental network, Capitec’s platform model and FirstRand’s data-driven culture meet that threshold.